Power Nickel To File Complaint on Widespread Potential Illegal Short Selling of its Shares

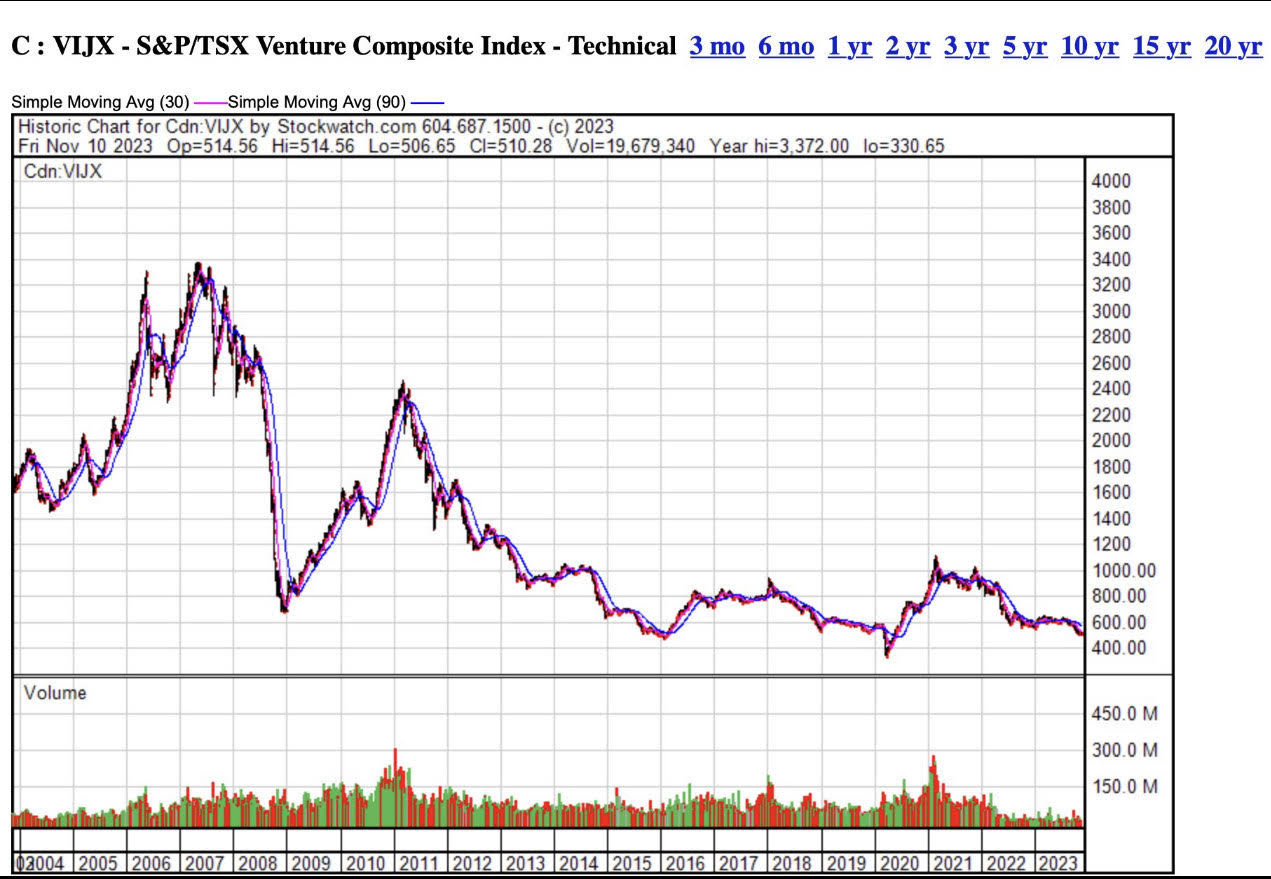

The takeaway is that it is not remotely normal for our stock market to be so severely depressed. Indeed, it is clear there is something fundamentally wrong with the price action on the TSXV and indeed all Canadian exchanges. In my volunteer unpaid role as founder of Save Canadian Mining we have tried to bring this problem to the attention of Canadian politicians and regulators.

This lobbying effort had no discernible benefit. Nothing was accomplished.

Honestly, I had to focus on my primary job as CEO of Power Nickel. I have done my best to support Save Canadian Mining and move progress along, but here we are. Shortly Power Nickel will file a formal complaint which should cause CIRO and FINRA to investigate the investment banks we have found who have persistently and consistently maintained significant imbalances in excess of 100,000 shares for a minimum period of 8 weeks. This imbalance started collectively around 3,000,000 shares and now stands at over 9,000,000 shares ON THE 80% OF THE FLOAT OF POWER NICKEL STOCK ON WHICH WE CAN OBTAIN FACTUAL INFORMATION.

With our permission, CDS, DTC, Broadridge, our transfer agent and more, provided Power Nickel data to ShareIntel-Shareholder Intelligence Services, LLC, who through their patented DRIL-DownTM process gathers actionable intelligence on behalf of publicly traded companies who engage their services, in an effort to uncover suspicious stock trading activity. Over the last 16 weeks alone, more than 9 million excess shares of Power Nickel were traded beyond what was likely delivered. According to the top attorney in the space, Wes Christian, the remaining approximately 20% of the float not captured can historically contain even larger imbalances. This persistent gap is costing investors and sabotaging Canada's critical minerals sector.

Power Nickel is not alone. At Save Canadian Mining over 20 other Canadian mining companies joined in industry collective action to bring fairness to the Canadian Capital markets. These firms and many many more are experiencing similar trading anomalies that are decimating share prices.

Recently, on October 13, 2023, The Globe and Mail reporter Niall McGee wrote a piece titled:

Canada wants to be a global leader in critical minerals. Why is Australia eating our lunch?

https://www.theglobeandmail.com/business/article-canada-critical-minerals-mining-australia/

The article is wondering why Canada is falling behind.

There are other issues affecting Canada’s junior mining industry. But every junior mining executive I have spoken to in the last three years believes the Predatory Short Selling problem is the biggest cause.

Our self-regulatory bodies are slow in finding proof on anything out of sorts. According to them, everything is fine and I fully expect that they will be very irritated at Power Nickel and myself for bringing this issue to a head. I did this very reluctantly. Power Nickel is a small company and the regulatory powers are immense. Nonetheless, we really have no choice. Almost every time we release good or great news (Power Nickel and its High Grade Nisk Nickel PGM Project have had, in my view, exceptional results) the stock has initial buying volume and then closes down. In our view, this is not normal behavior. This is predatory short selling. It also influences normal investors to believe the sell the news meme.

We are about to release an NI 43-101 report in the coming days and weeks and we believe it will be very good. We want to, as much as possible, ensure that normal market dynamics can assess this news and decide if we are undervalued or not. We want the shorts out of our market. The regulators have done nothing. We’ve had to take matters into our own hands, and spend our hard acquired Shareholder capital to prove that something is very badly amiss.

Similar share data to what Power Nickel has gathered has been successfully utilized contributing to multiple settlements of millions of dollars. This shows how real and effective this data is, and explains the interest in keeping it out of the public eye. The time has come for a full investigation and audit of the 7 investment dealer firms identified by Power Nickel. We are going to be bold now because being meek has got Power Nickel and its shareholders nowhere. We are calling on Premier Doug Ford to instruct the Ontario Securities Commission and Premier David Eby to instruct the British Columbia Securities Commission to oversee the CIRO investigation of Power Nickel trading at these seven firms. We want an audit of their books as it relates to Power Nickel trading. Audits randomly select shareholders for review, ensure that actual DRS exists which corresponds to their shareholding. Simply put, given the number of fines the industry has paid for mismarking trading tickets - it's not a sector we can trust. That is why regulators, in theory, exist. But they have not done their job. I personally believe self-regulatory bodies are a bad idea for financial markets. At the very least, we need an office of an empowered, educated, investor ombudsman to ensure they do their job.

Canadians deserve properly functioning markets, not ones sabotaged by complex trading schemes. Mining companies need access to capital to create jobs and opportunity in Canadian communities. The greening of our economy cannot happen without a healthy financial market.

Power Nickel asks concerned investors to join Save Canadian Mining and demand action from CIRO, FINRA, the Ontario Securities Commission and other relevant authorities. Healthy markets require oversight and enforcement. The future prosperity of Canada's mining sector hangs in the balance.

To learn more about this issue join Power Nickel CEO and Save Canadian Mining Founder Terry Lynch, Mining Industry Legend Eric Sprott, Leading Illegal Short Selling Litigator Wes Christian and Share Intel CEO David Wenger at our Black Friday Nov 24 Emergency Short Selling Session hosted at Link below.

https://events.6ix.com/preview/defend-your-investments-black-friday-short-selling-emergency-session

Signed Terry Lynch

PS It’s not just Mining but let’s start here!

For further information on Power Nickel Inc., please contact:

Mr. Terry Lynch, CEO

647-448-8044

terry@powernickel.com

For further information, readers are encouraged to contact:

Power Nickel Inc.

The Canadian Venture Building

82 Richmond St East, Suite 202

Toronto, ON

Neither the TSX Venture Exchange nor it's Regulation Services Provider accepts responsibility for the adequacy or accuracy of this release.

Cautionary Note Regarding Forward-Looking Statements

This message contains certain statements that may be deemed "forward-looking statements" concerning the Company within the meaning of applicable securities laws. Forward-looking statements are statements that are not historical facts and are generally, but not always, identified by the words "expects," "plans," "anticipates," "believes," "intends," "estimates," "projects," "potential," "indicates," "opportunity," "possible" and similar expressions, or that events or conditions "will," "would," "may," "could" or "should" occur. Although the Company believes the expectations expressed in such forward-looking statements are based on reasonable assumptions, such statements are not guarantees of future performance, are subject to risks and uncertainties, and actual results or realities may differ materially from those in the forward-looking statements. Such material risks and uncertainties include, but are not limited to, among others, the timing for the Company to complete its NI 43-101 report on Nisk; the ability to raise sufficient capital to fund its obligations under its property agreements and conduct desired exploration going forward; trading patterns in the Company’s shares and their impacts on the Company and the market for its common shares; the ability to maintain its mineral tenures and concessions in good standing; to explore and develop its projects; changes in economic conditions or financial markets; the inherent hazards associates with mineral exploration and mining operations; future prices of nickel and other metals; changes in general economic conditions; accuracy of mineral resource and reserve estimates; the potential for new discoveries; the ability of the Company to obtain the necessary permits and consents required to explore, drill and develop the projects and if accepted, to obtain such licenses and approvals in a timely fashion relative to the Company's plans and business objectives for the applicable project; the general ability of the Company to monetize its mineral resources; and changes in environmental and other laws or regulations that could have an impact on the Company's operations, compliance with environmental laws and regulations, dependence on key management personnel and general competition in the mining industry.