Our flagship NISK project is an exceptionally clean source of high-grade battery metals within one of the safest jurisdictions in the world.

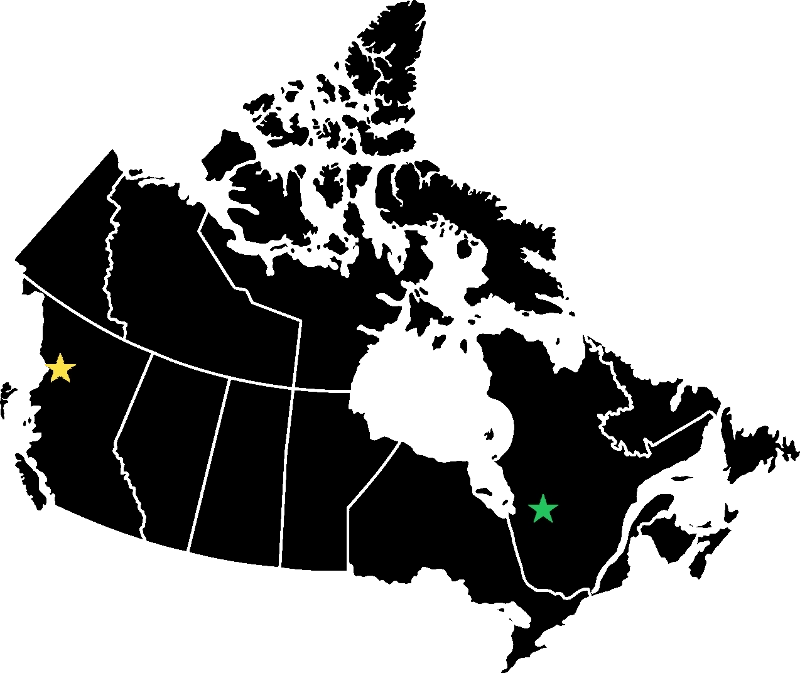

Located in Quebec, Canada the NISK project benefits from an abundant supply of low-carbon hydropower, shallow mineral depth and ultramafic tailings that enable the NISK project to be carbon neutral with minimal environmental impact.

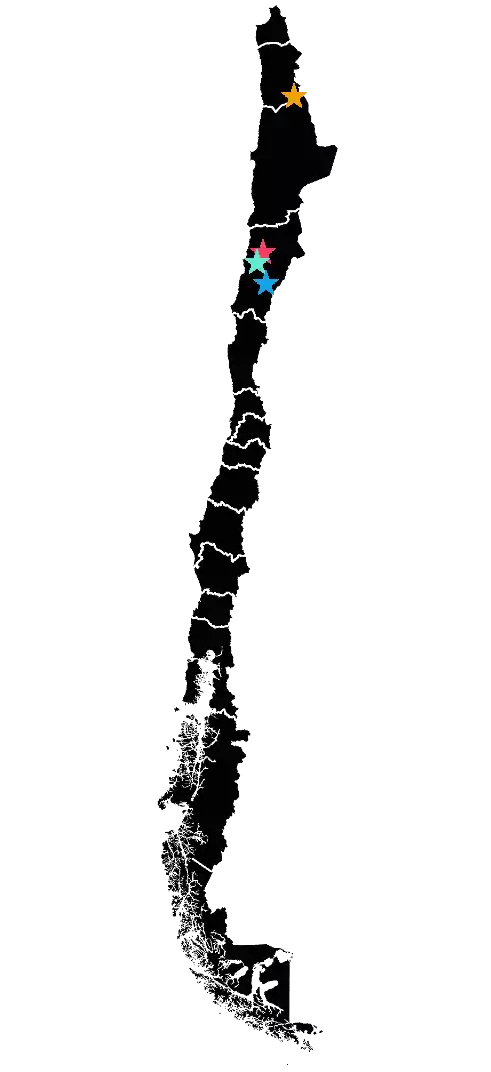

- Potentially Massive Strike Length: NISK contains two distinct high grade mineralized zones. They are separated by 5.5 Kilometres. The operating thesis is that these mineralized areas are connected sub-surface, creating a potentially huge mineralized area.

- High-Grade: NISK is blessed with two high grade mineralized zones. The initial discovery NISK Main featuring high-grade class-1 nickel with intercepts including 18.5m of 2.00% NiEQ and 26.6m of 1.98% NiEQ. The Lion Discovery highlights multiple 10 Metre Plus zones with with Copper ranging as high as 8%, PGMs in excess of 22 g/t, Gold In excess of 1.6 g/t and Silver in excess of 69 g/t.

- Carbon-Neutral: Carbon capture technology using the ultramafic tailings found at NISK enables us to sequester more carbon than the project will emit during its entire operation. Read our ESG & Sustainability Report

- Low-Cost: Access to inexpensive and abundant hydropower from a Hydro-Québec substation across the road, plus generous tax incentives and a shallow mineral depth.

- World-Class Mining Jurisdiction: The Quebec and Canadian governments combined offer tax credits that cover 50% of exploration cost, which means Power Nickel can spend $2 exploring for every $1 invested.

- Established Infrastructure: NISK is located beside a major highway with a Hydro-Quebec substation across the road and a nearby town with an airport.

Lion Discovery

Highlights

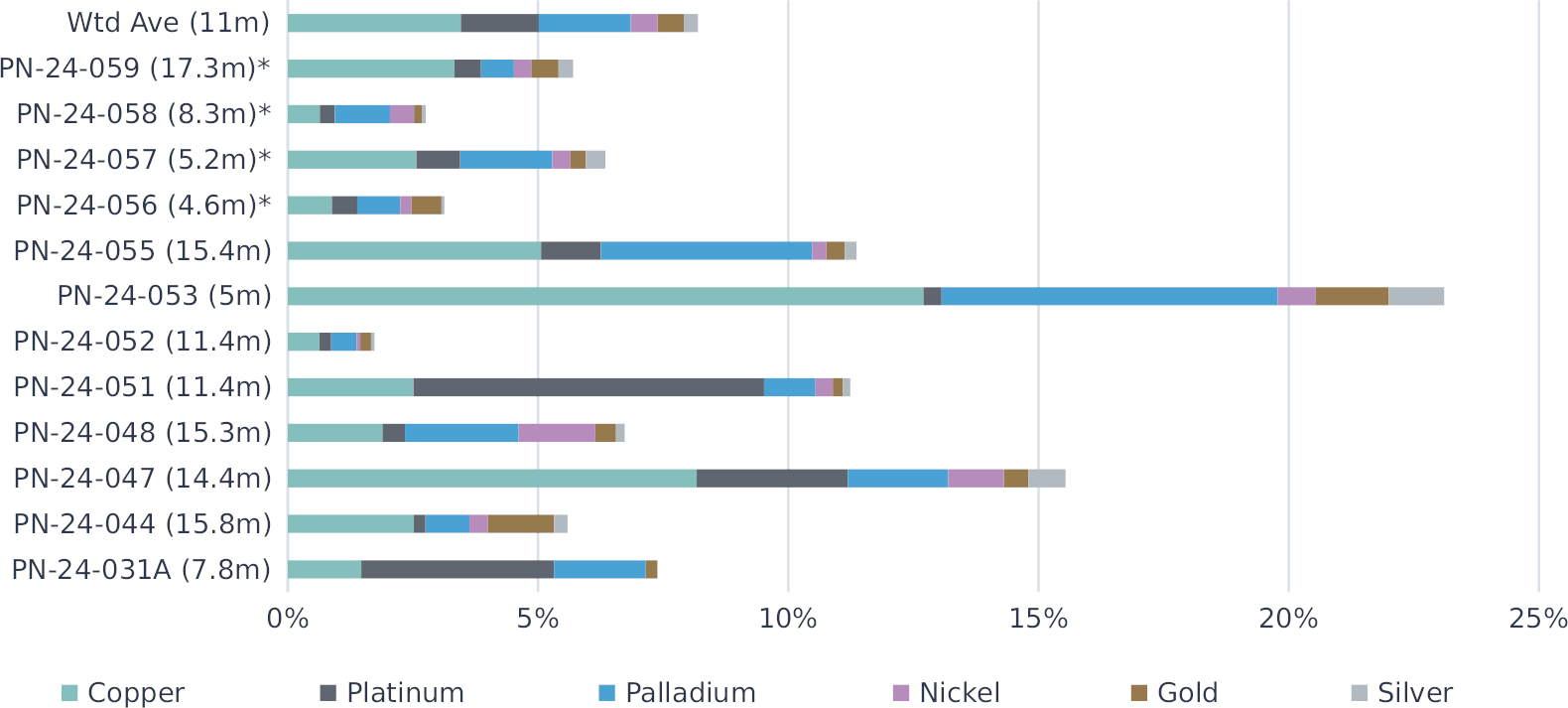

| Sample | CuEq Total | Copper | Platinum | Palladium | Nickel | Gold | Silver |

|---|---|---|---|---|---|---|---|

| PN-24-031A (7.8m) | 7.32% | 1.47% | 3.85% | 1.84% | 0.00% | 0.23% | 0.00% |

| PN-24-044 (15.8m) | 5.57% | 2.52% | 0.23% | 0.88% | 0.36% | 1.33% | 0.27% |

| PN-24-047 (14.4m) | 15.52% | 8.17% | 3.02% | 2.01% | 1.11% | 0.49% | 0.74% |

| PN-24-048 (15.3m) | 6.84% | 1.89% | 0.45% | 2.27% | 1.53% | 0.41% | 0.17% |

| PN-24-051 (11.4m) | 11.04% | 2.51% | 7.01% | 1.03% | 0.34% | 0.20% | 0.15% |

| PN-24-052 (11.4m) | 1.74% | 0.63% | 0.24% | 0.50% | 0.08% | 0.22% | 0.07% |

| PN-24-053 (5m) | 23.31% | 12.70% | 0.36% | 6.71% | 0.77% | 1.46% | 1.11% |

| PN-24-055 (15.4m) | 11.49% | 5.06% | 1.20% | 4.22% | 0.29% | 0.36% | 0.24% |

| PN-24-056 (4.6m)* | 3.13% | 0.88% | 0.51% | 0.86% | 0.23% | 0.60% | 0.06% |

| PN-24-057 (5.2m)* | 6.35% | 2.57% | 0.88% | 1.84% | 0.36% | 0.31% | 0.39% |

| PN-24-058 (8.3m)* | 2.76% | 0.64% | 0.30% | 1.10% | 0.48% | 0.16% | 0.08% |

| PN-24-059 (17.3m)* | 5.70% | 3.33% | 0.53% | 0.66% | 0.34% | 0.55% | 0.29% |

| Wtd Ave (11m) | 8.20% | 3.46% | 1.56% | 1.84% | 0.54% | 0.52% | 0.28% |