Company continues to expand its Near Surface High-Grade Copper, Platinum, Palladium, Gold and Silver Zone 5km Northeast of its Main Nisk Deposit

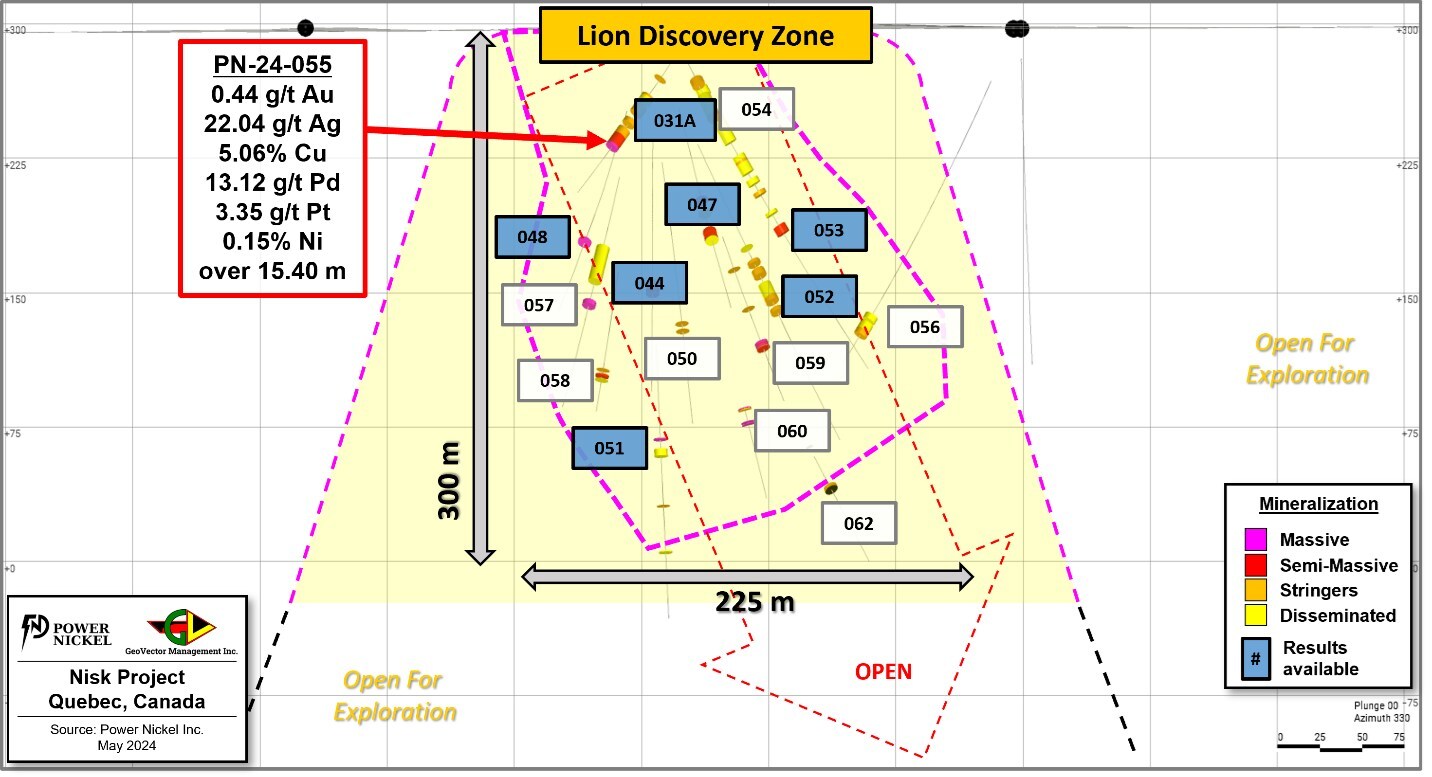

TORONTO , May 21, 2024 /CNW/ - Power Nickel Inc. (the "Company" or "Power Nickel") (TSXV: PNPN) is pleased to announce high-grade multi-elements assay results for hole PN-24-055. (see Figure 2 and Table 1 below)

Highlights:

PN-24-055 returned:

15.40 m of 0.44 g/t Au, 22.04 g/t Ag, 5.06% Cu, 13.12 g/t Pd, 3.35 g/t Pt and .015% Ni

Including:

5.05 m of 0.61 g/t Au, 50.29 g/t Ag, 13.27% Cu, 24.62 g/t Pd, 6.73 g/t Pt, and 0.33% Ni

With:

3.35 m of 0.70 g/t Au, 60.36 g/t Ag, 17.26% Cu, 25.02 g/t Pd, 3.61 g/t Pt and 0.37% Ni

"This is a special discovery; these are big intersections to be that high-grade and we are seeing a pattern here. This intersection is in the high-grade wheelhouse that is plus or minus 100 metres wide and seems to have a prospective mineralized halo around it of 50-75 metres. With copper and metal prices surging, this is such a great find. We are excited to see how this discovery can grow from here," commented Terry Lynch, Power Nickel CEO.

"The pictures plate below (see Figure 1) is becoming more and more exciting. Not only does current hole PN-24-055 show spectacular grades, but the thickness of the intersection is also equally impressive. I can't wait for the drills to start turning again… and with guidance from Dr. Beresford, I'm eager to see what we will come up with as we expand our exploration program," stated VP Exploration Ken Williamson.

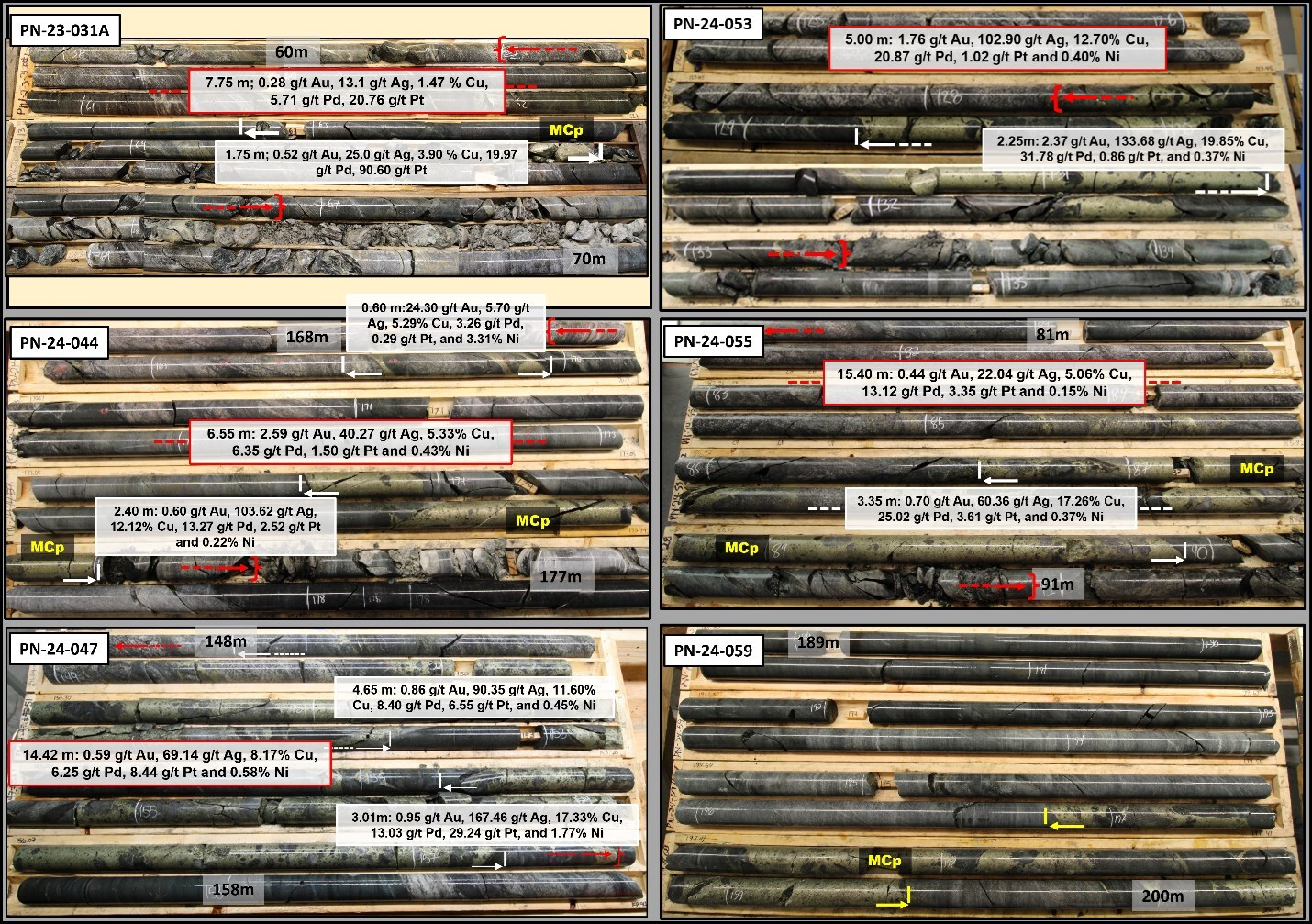

Figure 1 below presents core pictures of some of the best intersections to date. It is noticeable that the relative quantity of semi-massive chalcopyrite observed in both PN-23-031A and PN-24-044, while excellent, appeared to be dwarfed when compared to some of the other holes coming from the core of the zone. Hole PN-24-047 and PN-24-053 recently confirmed this observation, which is well supported by the results obtained for PN-24-055 (this release).

The Company's winter 2024 drill program ended with 15 successful holes at the Lion Discovery. Additional assays released keep supporting the ongoing progress on the discovery that has been made (see Figure 2 below). Power Nickel will continue to drill at the Lion Discovery in the upcoming summer season, following up PN-24-051 and PN-24-062, the deepest mineralized intersections to date.

Table 1 below presents the significant results of previously released holes, and the current Assay Status for the remaining holes of the program.

Table 1: Significant Results and Assay Status – Lion Discovery drilling winter 2024

(Holes presented in this release are shaded in grey)

Hole | From | To | Length | Au | Ag | Cu | Pd | Pt | Ni | CuEq Rec* |

PN-23-031A | 60.50 | 68.25 | 7.75 | 0.28 | n/a | 1.47 | 5.71 | 20.76 | n/a | 9.45 |

PN-24-044 | 160.25 | 176.00 | 15.75 | 1.60 | 25.34 | 2.52 | 2.73 | 0.65 | 0.19 | 4.48 |

Including | 160.25 | 162.65 | 2.40 | 3.27 | 51.18 | 1.49 | 0.20 | 0.01 | 0.03 | 3.94 |

Including | 169.45 | 176.00 | 6.55 | 2.59 | 40.27 | 5.33 | 6.35 | 1.50 | 0.43 | 9.06 |

with | 169.45 | 170.05 | 0.60 | 24.30 | 5.70 | 5.29 | 3.26 | 0.29 | 3.31 | 22.27 |

and | 173.60 | 176.00 | 2.40 | 0.60 | 103.62 | 12.12 | 13.27 | 2.52 | 0.22 | 16.39 |

PN-24-047 | 143.98 | 158.40 | 14.42 | 0.59 | 69.14 | 8.17 | 6.25 | 8.44 | 0.58 | 12.14 |

Including | 148.00 | 152.66 | 4.66 | 0.85 | 91.00 | 11.66 | 8.42 | 6.69 | 0.46 | 15.50 |

Including | 154.25 | 157.26 | 3.01 | 0.95 | 167.46 | 17.33 | 13.04 | 29.24 | 1.77 | 29.02 |

PN-24-048 | 147.00 | 162.27 | 15.27 | 0.50 | 16.13 | 1.89 | 7.07 | 1.26 | 0.80 | 4.86 |

Including | 148.00 | 153.00 | 5.00 | 0.94 | 12.76 | 1.14 | 14.23 | 2.92 | 0.06 | 7.55 |

Including | 159.55 | 161.25 | 1.70 | 1.27 | 99.84 | 12.30 | 15.45 | 0.60 | 0.38 | 17.17 |

PN-24-050 | 178.40 | 183.85 | 5.45 | Pending internal QAQC and verifications | ||||||

PN-24-051 | 232.40 | 243.80 | 11.40 | 0.24 | 13.95 | 2.51 | 3.20 | 19.59 | 0.18 | 9.14 |

Including | 232.40 | 235.00 | 2.60 | 0.40 | 41.18 | 8.09 | 8.37 | 84.75 | 0.54 | 34.77 |

Including | 238.00 | 242.90 | 4.90 | 0.23 | 7.53 | 1.32 | 2.47 | 0.53 | 0.12 | 2.30 |

PN-24-052 | 183.50 | 194.85 | 11.35 | 0.26 | 6.12 | 0.63 | 1.57 | 0.67 | 0.04 | 1.48 |

Including | 183.50 | 185.50 | 2.00 | 0.93 | 13.95 | 1.01 | 3.67 | 2.59 | 0.03 | 3.62 |

Including | 192.00 | 194.85 | 2.85 | 0.22 | 10.44 | 1.36 | 3.54 | 0.82 | 0.08 | 2.82 |

PN-24-053 | 128.30 | 133.30 | 5.00 | 1.76 | 102.90 | 12.70 | 20.87 | 1.02 | 0.40 | 19.89 |

Including | 129.30 | 131.55 | 2.25 | 2.37 | 133.68 | 19.85 | 31.78 | 0.86 | 0.37 | 30.10 |

PN-24-054 | 60.00 | 75.50 | 15.50 | Pending internal QAQC and verifications | ||||||

PN-24-055 | 75.50 | 90.90 | 15.40 | 0.44 | 22.04 | 5.06 | 13.12 | 3.35 | 0.15 | 9.54 |

Including | 84.85 | 89.90 | 5.05 | 0.61 | 50.29 | 13.27 | 24.62 | 6.73 | 0.33 | 21.02 |

with | 86.55 | 89.90 | 3.35 | 0.70 | 60.36 | 17.26 | 25.02 | 3.61 | 0.37 | 23.36 |

PN-24-056 | 196.30 | 204.85 | 8.55 | Pending internal QAQC and verifications | ||||||

PN-24-057 | 174.60 | 177.40 | 2.80 | Pending internal QAQC and verifications | ||||||

PN-24-058 | 200.60 | 204.70 | 4.10 | Pending internal QAQC and verifications | ||||||

PN-24-059 | 196.80 | 201.25 | 4.45 | Samples in preparation for analysis | ||||||

PN-24-060 | 230.00 | 231.60 | 1.60 | Samples in preparation for analysis | ||||||

PN-24-062 | 343.30 | 345.00 | 1.70 | Samples in preparation for analysis | ||||||

Note: Length is presented as downhole distance; true width corresponds to 60-80% of such downhole distance in function of the orientation of the hole. CuEq Rec represents CuEq calculated based on the following metal prices (USD) : 2,360.15 $/oz Au, 27.98 $/oz Ag, 1,215.00 $/oz Pd, 1000.00 $/oz Pt, 4.00 $/lb Cu, 10.00 $/lb Ni and 22.50 $/lb Co., and a recovery grade of 80% for all commodity, consistent with comparable peers. |

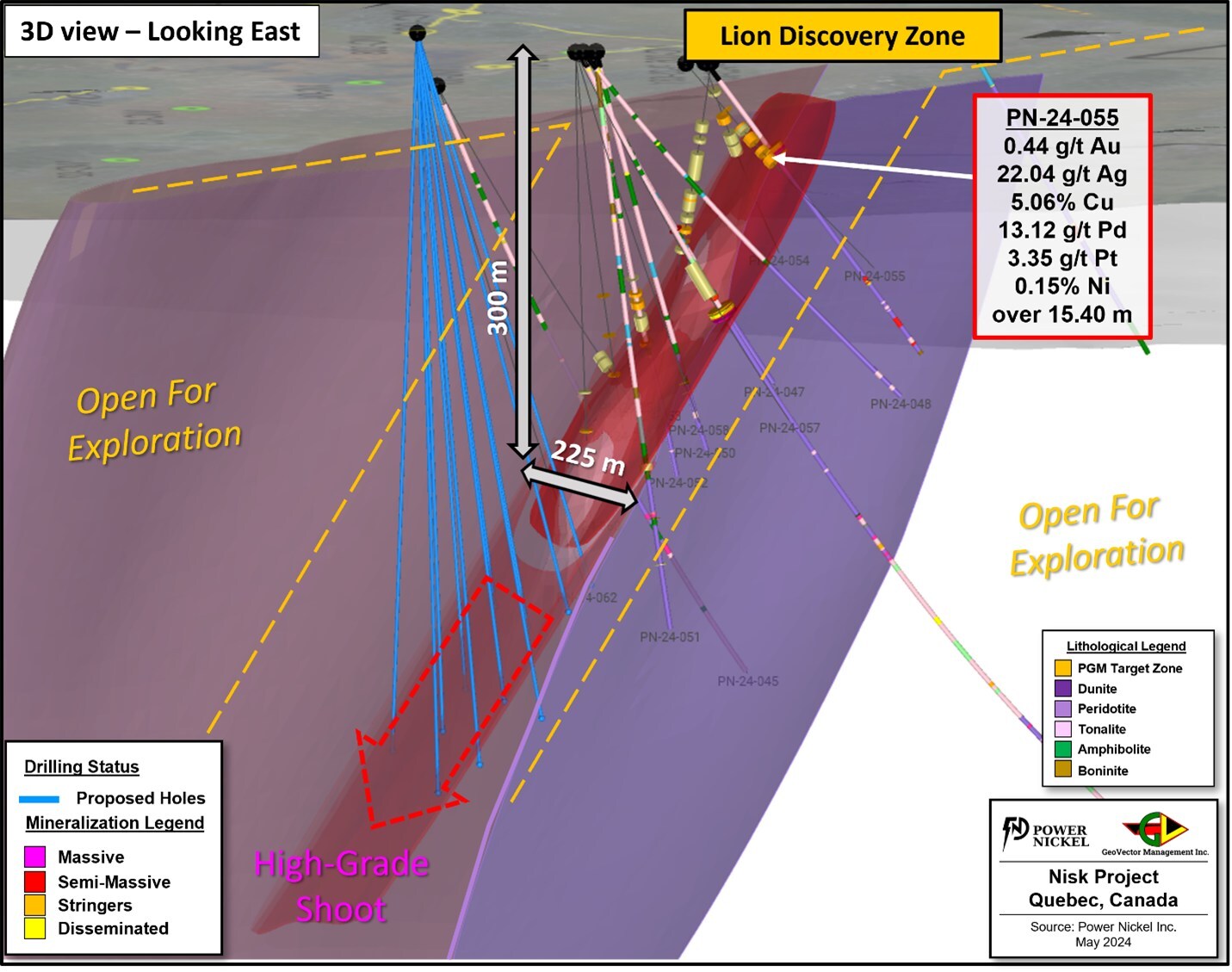

From the available data and observations, the mineralized zone can be followed 225m laterally and 300m deep. The thickness of the massive chalcopyrite zone varies, ranging from up to 5- 6 m true width in the core of the zone to less than 1 meter laterally. The core of the zone appears to be sheared and highly altered locally; considering the overall geological context in which the zone is hosted, and the knowledge acquired at Nisk Main, some degree of deformation is to be expected. In such scenario, hole PN-24-055 represents a near surface intersection through the core of the zone. 3D modeling and interpretation of secondary lithologies (dykes, sub-units) and structures from core logging and geochemistry data is ongoing as more results become available.

Figure 3 below is a 3D view of the Lion Discovery Zone which illustrates our current interpretation as well as the vast open ground area that could potentially be host of more than one of these mineralized zones.

QAQC and Sampling

GeoVector Management Inc ("GeoVector") is the Consulting company retained to perform the actual drilling program, which includes core logging and sampling of the drill core.

All samples were submitted to and analyzed at Activation Laboratories Ltd ("Actlabs"), an independent commercial laboratory for both the sample preparation and assaying. Actlabs is a commercial laboratory independent of Power Nickel with no interest in the Project. Actlabs is an ISO 9001 and 17025 certified and accredited laboratories. Samples submitted through Actlabs are run through standard preparation methods and analysed using RX-1 (Dry, crush (< 7 kg) up to 80% passing 2 mm, riffle split (250 g) and pulverize (mild steel) to 95% passing 105 μm) preparation methods, and using 1F2 (ICP-OES) and 1C-OES - 4-Acid near total digestion + Gold-Platinum-Palladium analysis and 8-Peroxide ICP-OES, for regular and over detection limit analysis. Pegmatite samples are analyzed using UT7 - Li up to 5%, Rb up to 2% method. Actlabs also undertake their own internal coarse and pulp duplicate analysis to ensure proper sample preparation and equipment calibration.

GeoVector's QAQC program includes regular insertion of CRM standards, duplicates, and blanks into the sample stream with a stringent review of all results.

The results presented in the current Press Released are complete within the mineralized intervals, but results are still pending for the top portion of both holes reported. QAQC and data validation was performed on these portions of the holes where assays are fully integrated, and no material error were observed.

Qualified Person

Kenneth Williamson, Géo, M.Sc., VP Exploration at Power Nickel, is the qualified person who has reviewed and approved the technical disclosure contained in this news release.

About Power Nickel Inc.

Power Nickel is a Canadian junior exploration company focusing on developing the high-grade Nisk project into Canada's first Carbon Neutral Nickel mine.

The NISK property comprises a significant land position (20 kilometers of strike length) with numerous high-grade intercepts. Power Nickel is focused on expanding the historical high-grade nickel-copper PGE mineralization with a series of drill programs designed to test the initial Nisk discovery zone and to explore the land package for adjacent potential Nickel deposits.

In addition to the Nisk project, Power Nickel owns significant land packages in British Colombia and Chile. The Company is in the process of reorganizing these assets in a related vehicle, through a Plan of Arrangement that will be presented to Power Nickel shareholders of record for their approval.

To obtain Power Nickel's Corporate Presentation, please use the link below:

http://powernickel.com/corporate_presentation.pdf

Neither the TSX Venture Exchange nor it's Regulation Services Provider accepts responsibility for the adequacy or accuracy of this release.

Cautionary Note Regarding Forward-Looking Statements

This message contains certain statements that may be deemed "forward-looking statements" concerning the Company within the meaning of applicable securities laws. Forward-looking statements are statements that are not historical facts and are generally, but not always, identified by the words "expects," "plans," "anticipates," "believes," "intends," "estimates," "projects," "potential," "indicates," "opportunity," "possible" and similar expressions, or that events or conditions "will," "would," "may," "could" or "should" occur. Although the Company believes the expectations expressed in such forward-looking statements are based on reasonable assumptions, such statements are not guarantees of future performance, are subject to risks and uncertainties, and actual results or realities may differ materially from those in the forward-looking statements. Such material risks and uncertainties include, but are not limited to, among others, the timing for the Company to close the private placement or the second Nisk option or risk that such transactions do not close at all; raise sufficient capital to fund its obligations under its property agreements going forward; to maintain its mineral tenures and concessions in good standing; to explore and develop its projects; changes in economic conditions or financial markets; the inherent hazards associates with mineral exploration and mining operations; future prices of nickel and other metals; changes in general economic conditions; accuracy of mineral resource and reserve estimates; the potential for new discoveries; the ability of the Company to obtain the necessary permits and consents required to explore, drill and develop the projects and if accepted, to obtain such licenses and approvals in a timely fashion relative to the Company's plans and business objectives for the applicable project; the general ability of the Company to monetize its mineral resources; and changes in environmental and other laws or regulations that could have an impact on the Company's operations, compliance with environmental laws and regulations, dependence on key management personnel and general competition in the mining industry.

For further information about Power Nickel, please contact:

Mr. Duncan Roy, VP Investor Relations

416-580-3862

duncan@powernickel.com

Power Nickel Inc.

The Canadian Venture Building

82 Richmond St East, Suite 202

Toronto, ON